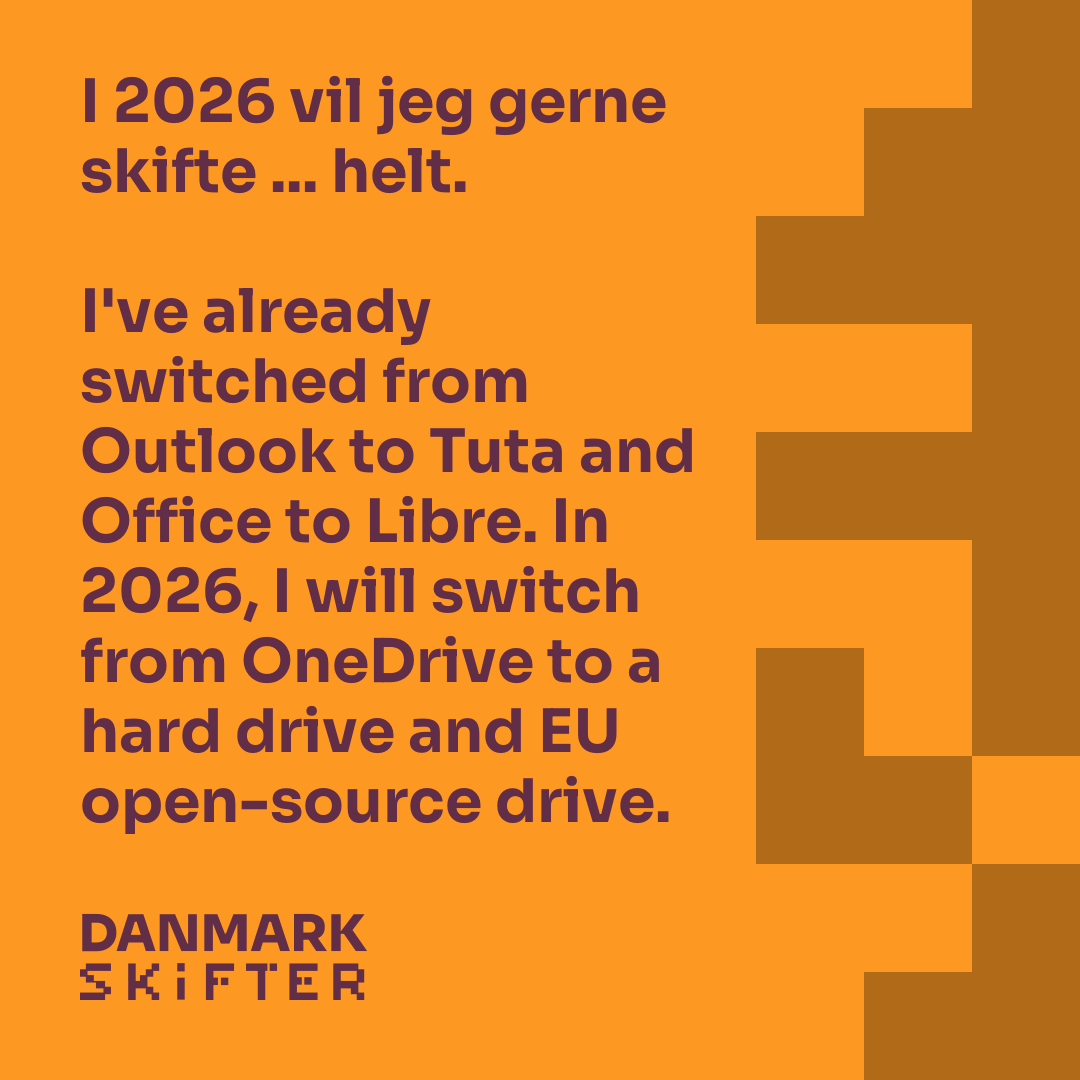

’Denmark Switches.’ A national campaign to collectively move off Big Tech.

-

@CiaraNi Good to see!

-

@Pepijn @CiaraNi @JohanEmpa @oldrup

I have been using Wise for more than two years for international payments, e.g., to Brazil.

Neither PayPal, my bank, nor Banco do Brasil, for example, can compete with it.

Exchange rates and fees are significantly cheaper.

Payments within Europe in euros cost nothing. No fees, nothing. And it's all in real time.

I even get really good daily interest on my credit balance, which many banks don't offer.

So, for me, it's the best choice.@hpmaennicke International payments between euro (sepa) accounts are always free if the banks were to do that transaction for free as a national transfer as well. It's a right you have and normal consumer banks follow that.

Between Danish kroner and euro Wise is simply more expensive than my Danish and Dutch banks. It's the same experience with similar services. At least Wise doesn't appear to be blatantly advertising about it anymore.

-

@CiaraNi Good to see!

-

@hpmaennicke International payments between euro (sepa) accounts are always free if the banks were to do that transaction for free as a national transfer as well. It's a right you have and normal consumer banks follow that.

Between Danish kroner and euro Wise is simply more expensive than my Danish and Dutch banks. It's the same experience with similar services. At least Wise doesn't appear to be blatantly advertising about it anymore.

Euro transfers with Wise are always free, with no bank fees and even interest on your balance. It’s the cheapest option for transactions to Brazil, handling all taxes. In Brazil, users earn 10% interest on their credit balance (taxes are paid directly to authorities).

As I said, it depends on your personal commitment. -

@Pepijn @hpmaennicke Good to know. My own intention after deleting my Paypal is to stick with my bank card. I used PayPal for the bare minimum anyway. I want fewer companies, fewer apps etc in my life generally at this point.

@CiaraNi For the past decade I've only ever had two payment accounts (one each in euro & DKK) and have never been unable to pay.

I stopped looking for alternatives. Last time I did was with a company named Transferwise. They also pretended to be "cheaper than your bank", doing a lot of ads etc.. After the first transaction I figured I'd do an actual check. Aaand it would've cheaper with my bank: their online calculator thingy literally lied about what my bank would've charged me.

-

Euro transfers with Wise are always free, with no bank fees and even interest on your balance. It’s the cheapest option for transactions to Brazil, handling all taxes. In Brazil, users earn 10% interest on their credit balance (taxes are paid directly to authorities).

As I said, it depends on your personal commitment.>As I said, it depends on your personal commitment.

No, it depends on facts

It's a simple fact that often this company is not the cheapest, even though they claim to be. And I'm sure that in other situations they are the cheapest and their claim is correct.

It's a simple fact that often this company is not the cheapest, even though they claim to be. And I'm sure that in other situations they are the cheapest and their claim is correct.It's only fair that people know that.

-

@CiaraNi For the past decade I've only ever had two payment accounts (one each in euro & DKK) and have never been unable to pay.

I stopped looking for alternatives. Last time I did was with a company named Transferwise. They also pretended to be "cheaper than your bank", doing a lot of ads etc.. After the first transaction I figured I'd do an actual check. Aaand it would've cheaper with my bank: their online calculator thingy literally lied about what my bank would've charged me.

Oh. As I looked what happened to Transferwise I learned it rebranded into Wise. That explains why it feels so similar

Anyway. Just hope that people looking to use #Wise do a proper check with their own bank to see if it's actually cheaper. Despite claims, it might not be.

-

@CiaraNi For the past decade I've only ever had two payment accounts (one each in euro & DKK) and have never been unable to pay.

I stopped looking for alternatives. Last time I did was with a company named Transferwise. They also pretended to be "cheaper than your bank", doing a lot of ads etc.. After the first transaction I figured I'd do an actual check. Aaand it would've cheaper with my bank: their online calculator thingy literally lied about what my bank would've charged me.

@Pepijn Apart from the couple of PayPal subs I had, which are now deleted, I've been the same. One DKK bank card, one Euro bank card, no bank apps - never not been able to pay or transfer.

-

Oh. As I looked what happened to Transferwise I learned it rebranded into Wise. That explains why it feels so similar

Anyway. Just hope that people looking to use #Wise do a proper check with their own bank to see if it's actually cheaper. Despite claims, it might not be.

@Pepijn @hpmaennicke Good advice, that I hope that applies for any new bank or supplier, that we always remember to check beneath the advertising.

-

@CiaraNi For the past decade I've only ever had two payment accounts (one each in euro & DKK) and have never been unable to pay.

I stopped looking for alternatives. Last time I did was with a company named Transferwise. They also pretended to be "cheaper than your bank", doing a lot of ads etc.. After the first transaction I figured I'd do an actual check. Aaand it would've cheaper with my bank: their online calculator thingy literally lied about what my bank would've charged me.

@Pepijn @CiaraNi

I had the advantage of not having to "believe" Wise's advertising. I had concrete data from my bank for money transfers to Brazil.

And these were and still are not competitive with Wise. Exchange rates and fees are a good 50% cheaper.

Yes, and I get 1.76% interest on my euros every day.

No one has to use it. But it's European and I love it. -

@Pepijn @CiaraNi

I had the advantage of not having to "believe" Wise's advertising. I had concrete data from my bank for money transfers to Brazil.

And these were and still are not competitive with Wise. Exchange rates and fees are a good 50% cheaper.

Yes, and I get 1.76% interest on my euros every day.

No one has to use it. But it's European and I love it.@hpmaennicke @Pepijn It's always good to hear of European alternatives. US giants have dominated the market and the conversation for so long that most of us haven't even heard of the European alternatives, so we don't even know they exist. It's useful to share more names so that we have alternatives to look into in the first place

-

Oh. As I looked what happened to Transferwise I learned it rebranded into Wise. That explains why it feels so similar

Anyway. Just hope that people looking to use #Wise do a proper check with their own bank to see if it's actually cheaper. Despite claims, it might not be.

@Pepijn @CiaraNi

It is cheaper to transfer money to Brazil with Wise. Even when I transfer euros, the exchange rate to Brazilian real is more favorable there. Please note: From Wise to Wise.

And transferring money to your own Brazilian account there is free of charge. But only with the local currency.

This is not advertising, but fact. -

@Pepijn @CiaraNi

It is cheaper to transfer money to Brazil with Wise. Even when I transfer euros, the exchange rate to Brazilian real is more favorable there. Please note: From Wise to Wise.

And transferring money to your own Brazilian account there is free of charge. But only with the local currency.

This is not advertising, but fact.@hpmaennicke Sure. But they claim that "cheaper" in other situations as well where they are objectively not. This is why with their previous "Transferwise" name they got into problems.

-

@hpmaennicke Sure. But they claim that "cheaper" in other situations as well where they are objectively not. This is why with their previous "Transferwise" name they got into problems.

@Pepijn @CiaraNi

Since rebranding from Transferwise to Wise, they’ve significantly improved transparency—fees and exchange rates are now clearly broken down upfront. My experience with international transfers has been consistently positive: fair, fast, and no hidden costs. Anyone else noticed this change? Or have counterexamples? #Finance #Wise #Transparency -

@Pepijn @CiaraNi

Since rebranding from Transferwise to Wise, they’ve significantly improved transparency—fees and exchange rates are now clearly broken down upfront. My experience with international transfers has been consistently positive: fair, fast, and no hidden costs. Anyone else noticed this change? Or have counterexamples? #Finance #Wise #Transparency@hpmaennicke Some counter-examples were offered in this thread (like: https://mastodon.online/@Pepijn/115916901596229842)

Their current wording is "meh":

"Best Euro rate" - True. It's also the exact same rate as my bank.

"No hidden fees" - True. Same for the bank.

So that leaves the Transfer fee. And on various transactions I check it's all more than my bank.

They were fined for this https://en.wikipedia.org/wiki/Wise_(company)

Again, good if it IS cheaper. But in many situations it isn't. Why not be honest?

-

@hpmaennicke Some counter-examples were offered in this thread (like: https://mastodon.online/@Pepijn/115916901596229842)

Their current wording is "meh":

"Best Euro rate" - True. It's also the exact same rate as my bank.

"No hidden fees" - True. Same for the bank.

So that leaves the Transfer fee. And on various transactions I check it's all more than my bank.

They were fined for this https://en.wikipedia.org/wiki/Wise_(company)

Again, good if it IS cheaper. But in many situations it isn't. Why not be honest?

@Pepijn

I'm just talking about my experience. Nothing more. And everything is true.And if we're honest, we know that (almost) all banks earn a lot of money with our money.

And compared to PayPal, Wise is always the better partner.

If #Wero continues to gain momentum in Europe, a lot can change. But only in Europe. (Like PIX in Brazil). -

G gambolputte@expressional.social shared this topic

G gambolputte@expressional.social shared this topic

-

@Pepijn

I'm just talking about my experience. Nothing more. And everything is true.And if we're honest, we know that (almost) all banks earn a lot of money with our money.

And compared to PayPal, Wise is always the better partner.

If #Wero continues to gain momentum in Europe, a lot can change. But only in Europe. (Like PIX in Brazil).@hpmaennicke Sure. But let's be clear to others then and don't suggest that the experience is the same for everyone.

And to be honest, I'd rather have real European banks work well* than yet another US owned company like #Wise.

*which they do: every private person can send and receive euros for free from and to every euro / sepa country. No extra in-between company is needed for that.

edit: I've deleted the rest of my replies. For all reading this: check Wikipedia, "funding" and fines.

-

@hpmaennicke Sure. But let's be clear to others then and don't suggest that the experience is the same for everyone.

And to be honest, I'd rather have real European banks work well* than yet another US owned company like #Wise.

*which they do: every private person can send and receive euros for free from and to every euro / sepa country. No extra in-between company is needed for that.

edit: I've deleted the rest of my replies. For all reading this: check Wikipedia, "funding" and fines.

@Pepijn

Wise is not an American bank—it’s a UK-based FinTech company, founded and headquartered in London. While it partners with US banks (like Wells Fargo) to offer local account details for USD transactions, Wise itself is regulated in Europe (by the National Bank of Belgium) and operates globally as a payment institution, not a traditional bank. Always transparent about fees and exchange rates! -

Since 2021 Wise plc (ISIN: GB00BL9YR756) is listed and traded on the London Stock Exchange."

Wise is not a US-dominated company. The largest single shareholder is anonymous, and while US investors like Andreessen Horowitz hold significant but non-majority stakes, the majority of shares are widely distributed. Control remains with the founders and European investors. -

@Pepijn

As a resident of Brazil, you cannot open an account with any European banking service provider. This makes all transfers to Brazil very expensive.

Only Wise offers account opening in Brazil in accordance with government financial regulations.

Incidentally, the majority of shares are not held by American shareholders, and the shares are only traded in London.